The UK has seen growing demand for cataract surgery in recent years. Last month the Cabinet Secretary for Health and Social Care in Wales, Jeremy Miles, announced a £120m NHS funding package; within this, a plan to deliver an additional 20,000 cataract surgeries per year.

Despite the funding boost, a large number of patients needing eye care remain untreated. The waiting list for secondary eye care treatment is one of the largest in the NHS, with nearly 600,000 people waiting in England as of December 2024.

The Government is enlisting the help of the private sector to reduce pressures on hospitals. Private ophthalmology providers are well positioned to capture growing patient volumes and alleviate public sector backlogs.

Key Trends in Vision Care Sector

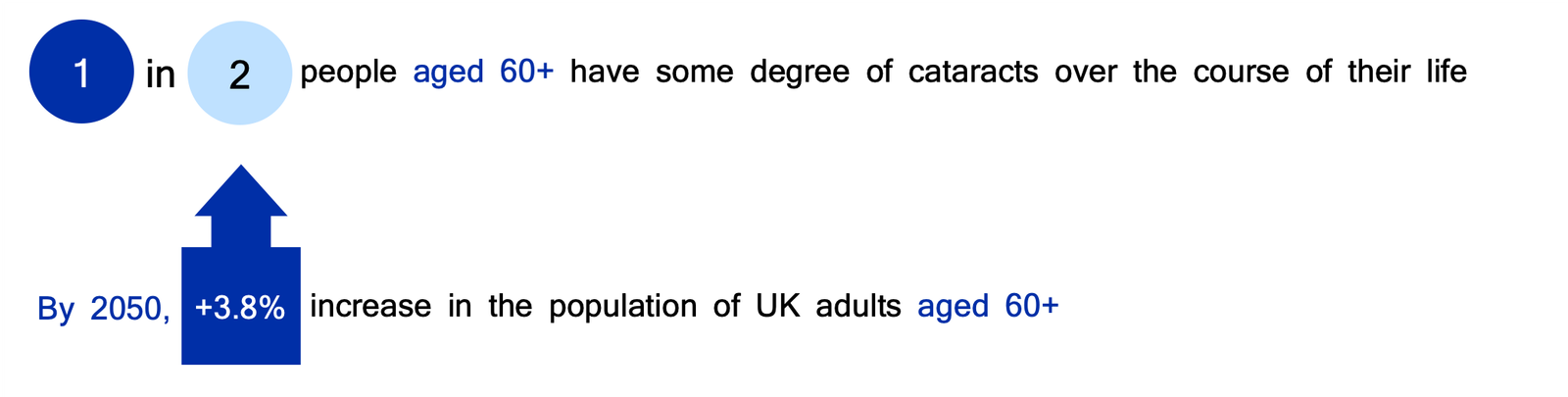

An Ageing Population

Growing Demand for Cataract Surgery

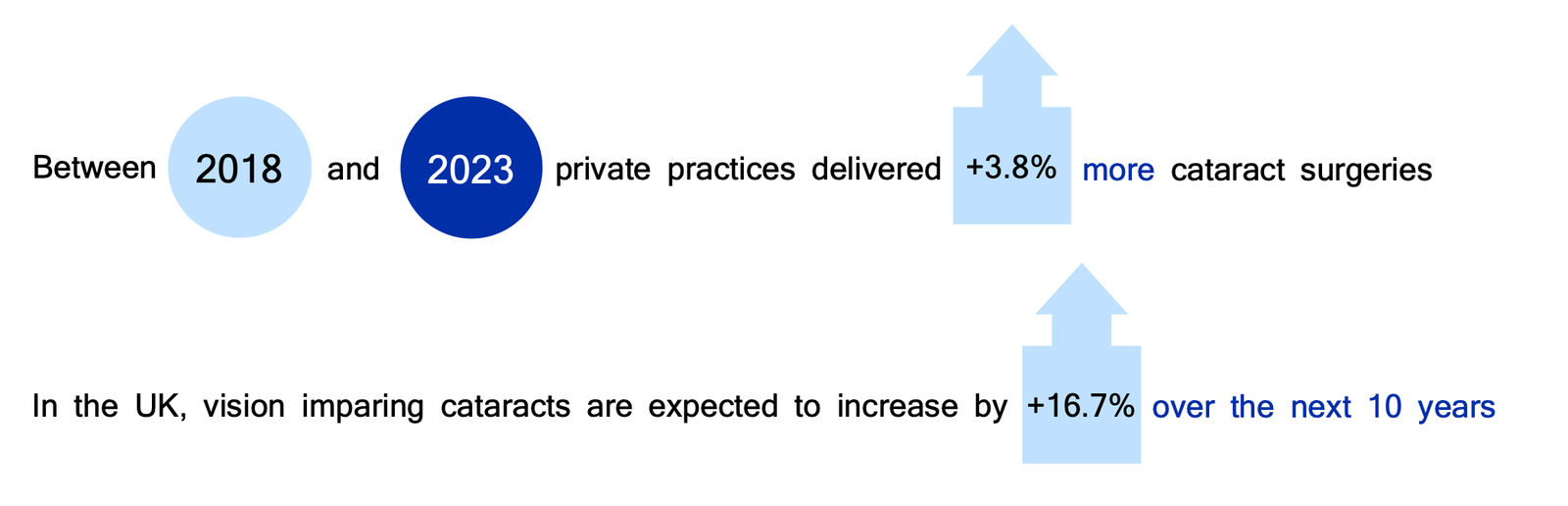

Premiumisation of Healthcare in Britain

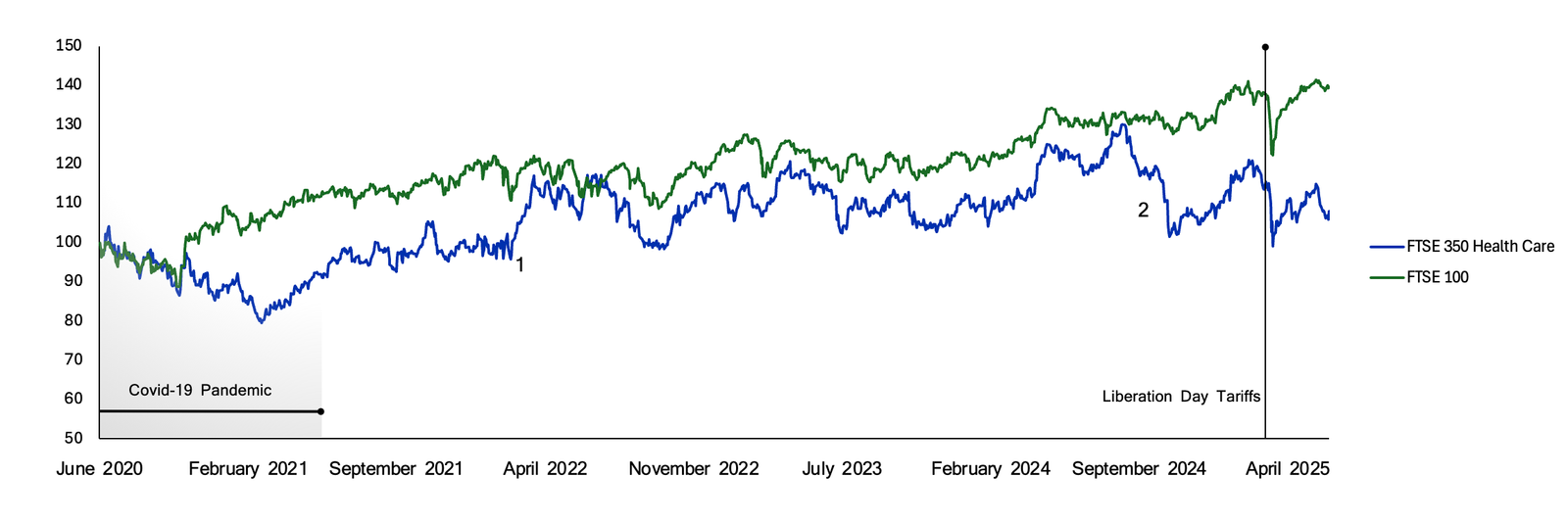

Market sentiment in Private Healthcare Sector

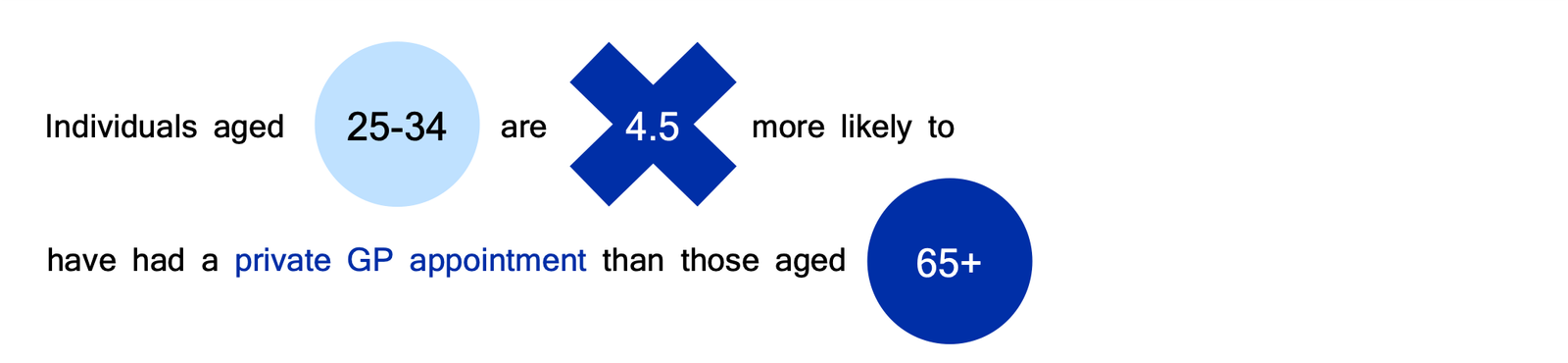

Historical Trading Data

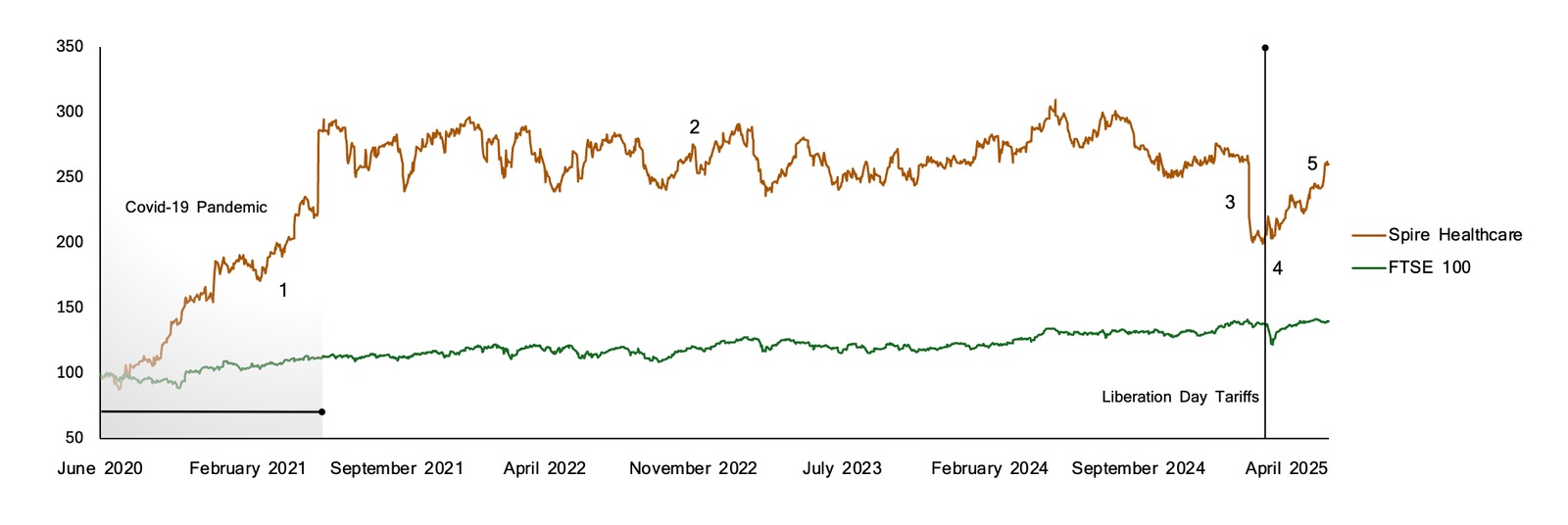

Relative % Stock Price Change, Normalised to 29th June 2020

In the last five years, structural tailwinds have been met with market volatility. Inflation expectations and Delta variant concerns in March 2021 (1) drove demand for defensive exposure. Capital inflows into health and biopharma increased. Ongoing COVID-19-related healthcare spending boosted revenue visibility for UK healthcare firms. Rising optimism around vaccine rollout logistics and strong biopharma earnings expectations led to gains in the FTSE 350 Health Care Index.

In contrast, 2024 experienced a return in risk appetite. The FTSE 350 Health Care Index fell in August 2024 as the United Kingdom’s GfK Consumer Confidence Index rose. Capital moved from defensive sectors towards growth-oriented technology and cyclical industrial sectors; evidenced by a rise in the FTSE 350 General Industrials and Technology Indices. A further divergence followed post-Liberation Day tariffs.

Whilst the FTSE 350 Health Care Index measures wider sentiment in the health and biopharma industry, it fails to capture sector specific sentiment; particularly within private healthcare, which is the interest of this report.

Spire Healthcare (SPI) is the only major private healthcare provider currently listed on the London Stock Exchange. Its share price performance can be used as a rough proxy for investor sentiment towards the broader UK private healthcare sector.

Two events have moved the price of SPI stock since June 2020: the Covid-19 Pandemic recovery and a March Earnings Report.

Relative % Stock Price Change, Normalised to 29th June 2020

- SPI share price begins trending upwards in July 2020 due to investor pre-positioning around anticipated demand growth for private healthcare; demand driven by NHS backlogs and a growing shift in consumer preferences towards private healthcare.

- Valuations oscillate in a narrow band (240p – 290p) with post-pandemic mature expectations pricing in.

- SPI stock falls 18% because of a weaker-than-expected Earnings Report in March 2025. The cause: rising payroll costs and a shift away from high-margin Self Pay services towards lower-margin insured patients. The company’s 2025 EBITDA guidance came in 7.2% below consensus, disappointing investors also.

- Tariff-related shocks in April 2025 do not impact valuations; SPI Group had already faced a sharp reprice in March 2025 due to internal fundamentals.

- With tariffs on pause, a subsequent rebound to 224p reflects investor confidence in long-term structural tailwinds. Notably, the ageing population and the premiumisation of private healthcare services.

Investor sentiment in the UK private healthcare sector remains strong, significantly outperforming the broader FTSE 350 Healthcare Index. The sector is supported by positive structural tailwinds and long-term fundamentals, with investors increasingly viewing companies like SPI as key beneficiaries of sustained private healthcare expansion in the UK.

Future performance will depend on the policy environment surrounding NHS outsourcing, and the pace of sector consolidation through M&A activity.

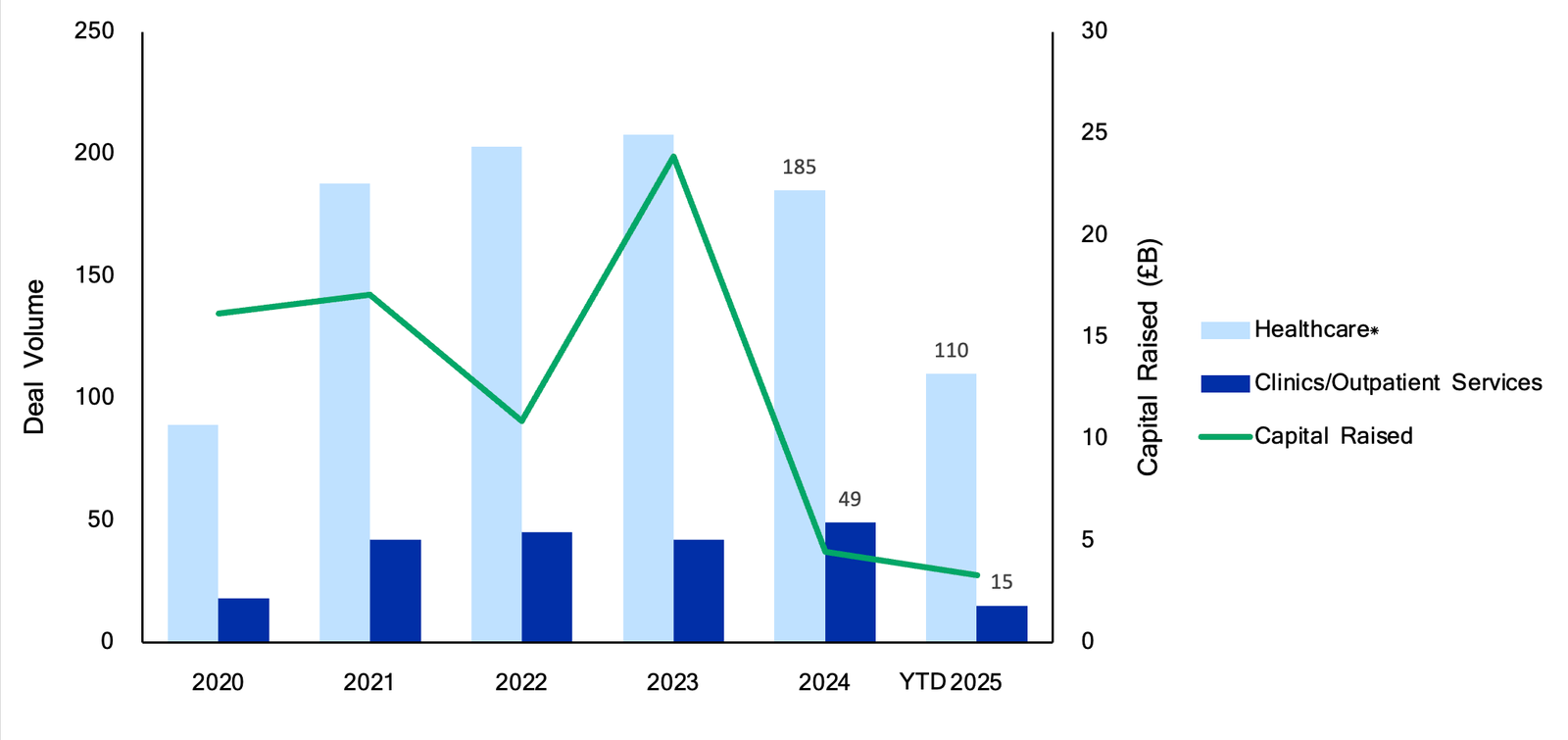

M&A Overview

UK Corporate/Strategic M&A Healthcare Deal Volumes

*not including Clinics/Outpatient Services M&A Deals

There has been strong M&A activity in the UK healthcare sector following the COVID-19 Pandemic. Overall healthcare deal volumes have remained resilient, with a notable peak in 2023 and only a modest decline into 2025.

Capital raised has dropped sharply however, falling by £20bn in 2024 and continuing to decline into 2025. This indicates a cautious investment environment. Investors are shifting towards smaller transactions or more disciplined spending.

Clinics and Outpatient Services (C&OS) includes non-hospital medical facilities such as diagnostic centres, urgent care and specialist treatment clinics. This sub-sector has attracted interest in recent years, peaking at 49 UK deals in 2024.

2025 has seen a slowdown in C&OS deal activity however. Price expectations are harder to meet within this sub-sector and buyers have become more selective. Some independent providers may be holding off on growth plans or delaying exits, with poor market clarity likely lowering C&OS deal volume later this year.

EssilorLuxottica Overview

EssilorLuxottica is a Franco-Italian multinational holding company. Headquartered in Paris, it was founded in 2018 from the merger of Essilor and Luxottica; the former a leading ophthalmic lens producer and the latter a luxury eyeglass making giant.

Together, EssilorLuxottica has become a juggernaut of the eyewear industry. The company employs approximately 200,000 people globally and has a current market capitalisation of over £92bn.

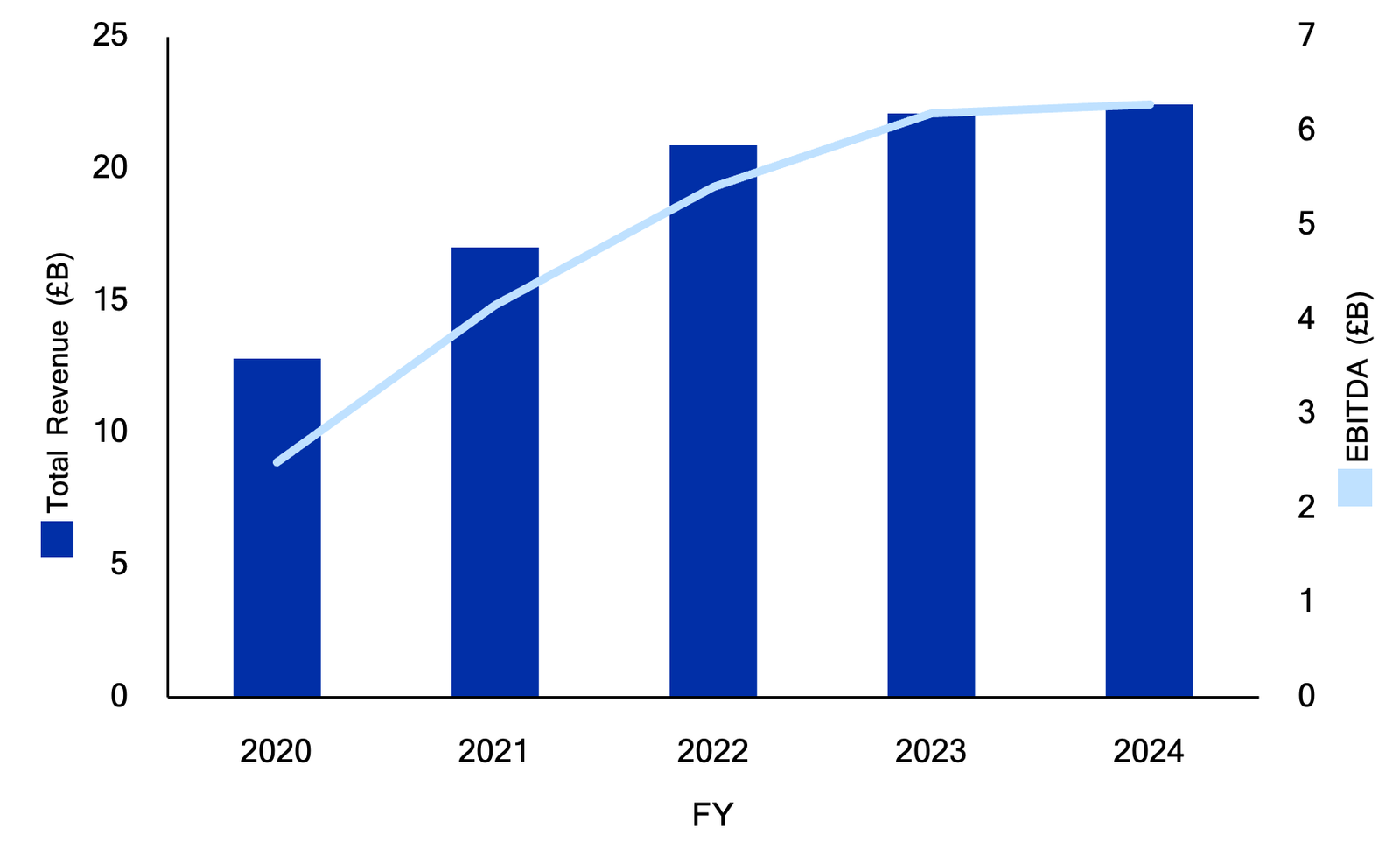

FY Revenues and EBITDA

EssilorLuxottica’s year-on-year revenue has almost doubled to £22.45B in the last five years. The company has a current enterprise multiple of 18.6; its two largest competitors, Kering S.A. and Tapestry, Inc, have current enterprise multiples of 9.5 and 14.9 respectively.

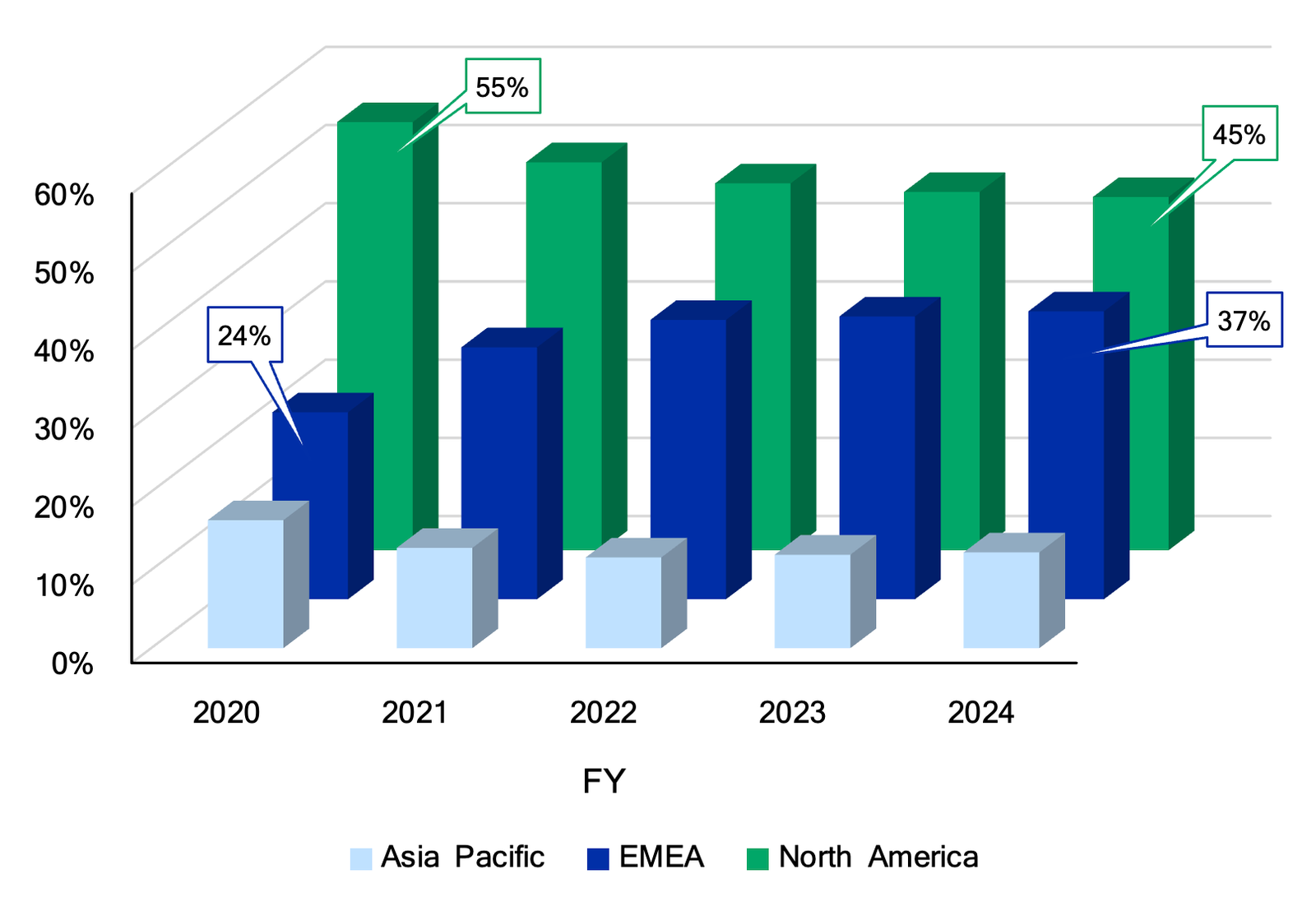

Revenue Breakdown by Region

EssilorLuxottica’s revenue has grown in absolute terms in all regions since 2020. In North America and in relative terms, Sunglass Hut underperformance has lowered its share of total revenue by 10%. Asia Pacific remains an emerging opportunity, but growth is not yet share-accretive. EMEA has delivered the strongest absolute revenue growth, driven by GrandVision integration and strong European retail demand for premium brands like Ray-Ban and Oakley.

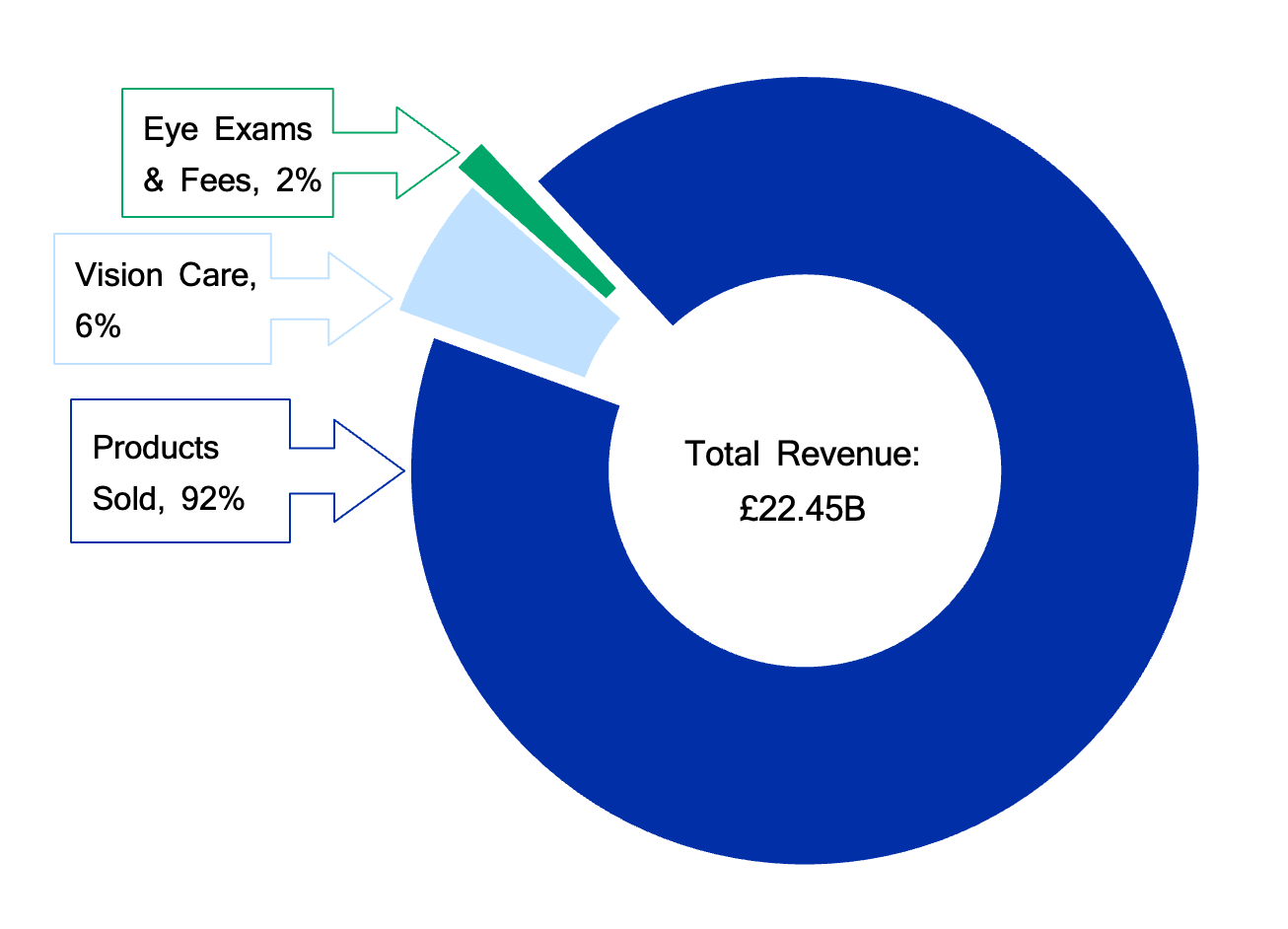

2024 Revenue Breakdown by Product/Service

EssilorLuxottica remains overwhelmingly product-driven, with minimal exposure to recurring service revenues; expansion in vision care and eye exams offers potential margin upside to the Franco-Italian monopolist.

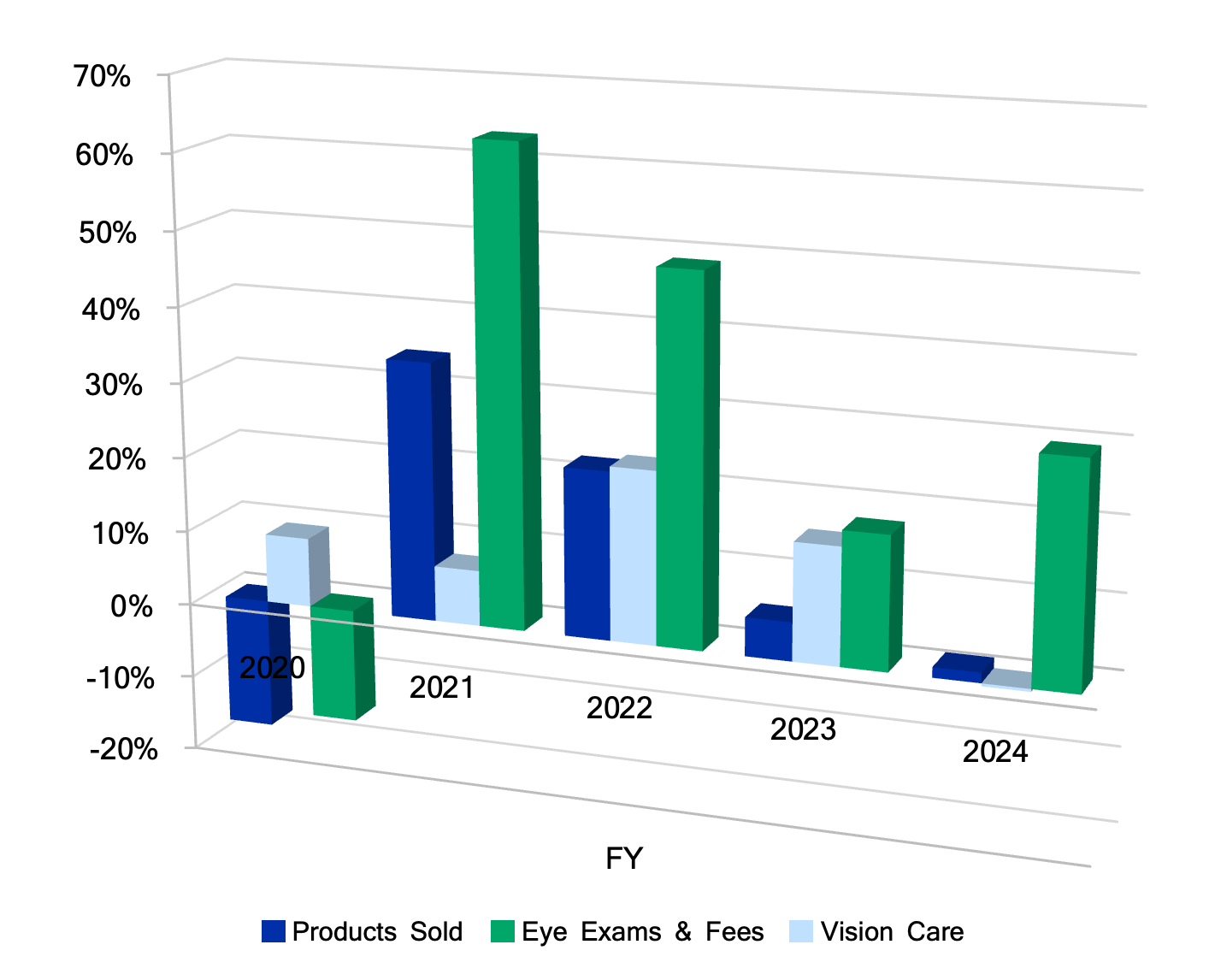

Annual Revenue Growth by Product/Service

Growth within revenue streams has fluctuated significantly; a sharp post-pandemic rebound in 2021 was followed by normalised growth from 2022 onwards. Eye Exams revenues have consistently outpaced other segments, with Vision Care and Products Sold revenues tapering to 0% in FY 2024.

Revenue growth in Eye Exams and Vision Care has been fuelled by the post-pandemic recovery in in-person eye exams and routine care, alongside early contributions from EssilorLuxottica’s M&A-driven expansion into ophthalmology clinics.

Prior Deals

EssilorLuxottica was acquired by Essilor for approximately $62.95B on October 1, 2018, creating a branded goods giant with a market value of around $101.53B.

Since then, the company has executed a series of targeted acquisitions, completing 18 transactions; eight of which are within the ophthalmology sector.

EssilorLuxottica Ophthalmology-Only Investments

Note: Area of bubble reflects deal size

The eight Ophthalmology-only purchases span clinical services, diagnostics, retail distribution and smart eyewear. They align with EssilorLuxottica’s shift from a pure-play optical brand to a full-spectrum eyecare platform company.

This report focuses on one specific acquisition: EssilorLuxottica’s move to acquire Optegra.

Optegra Overview

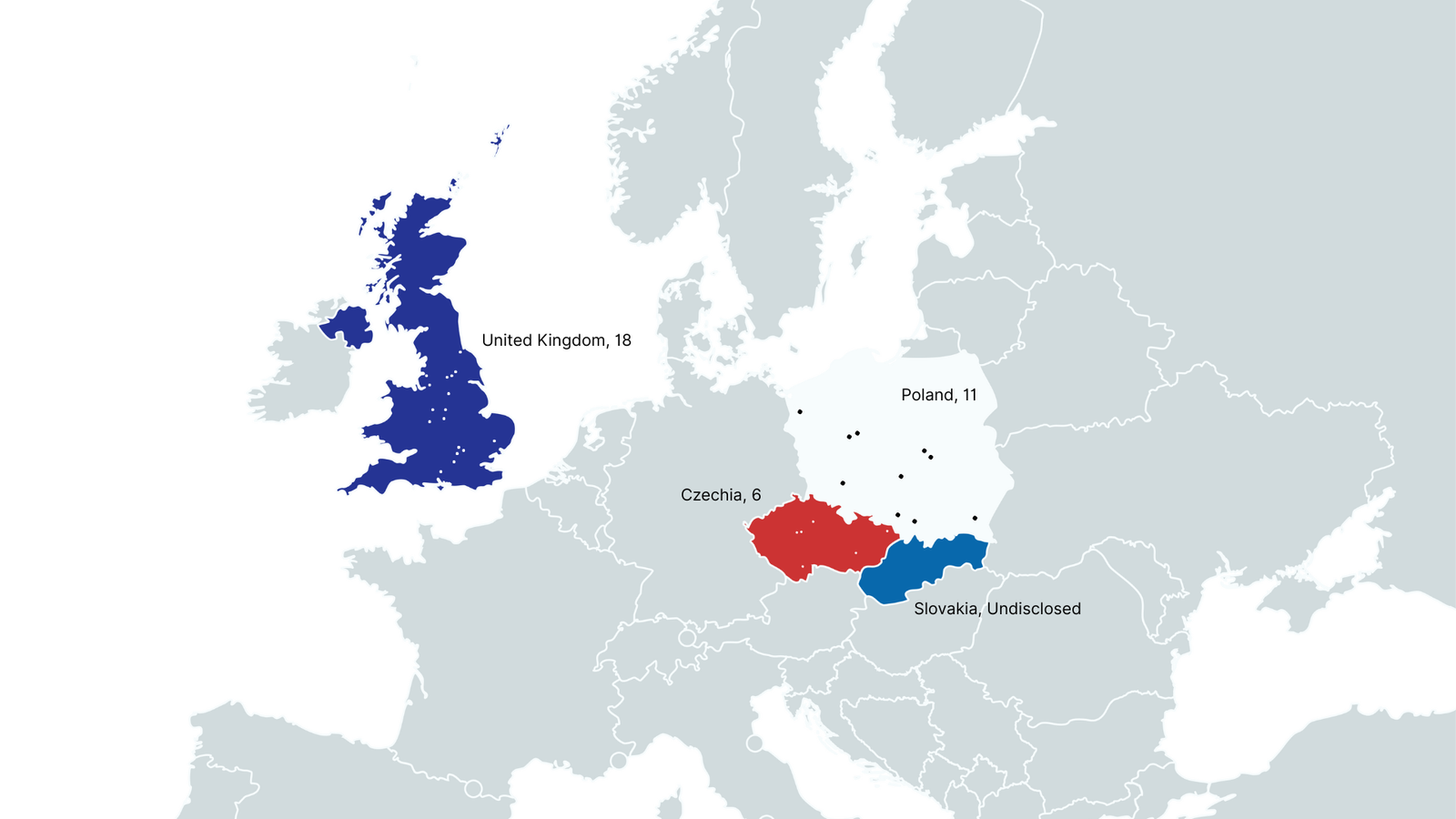

Optegra is an AI-focused ophthalmology platform with 18 eye clinics and diagnostic facilities located in the UK and more than 70 across Europe. The company’s hospitals offer cataract removal, laser eye surgery, lens replacement and medical eye treatment facilities.

Mapping Optegra Group’s Clinics

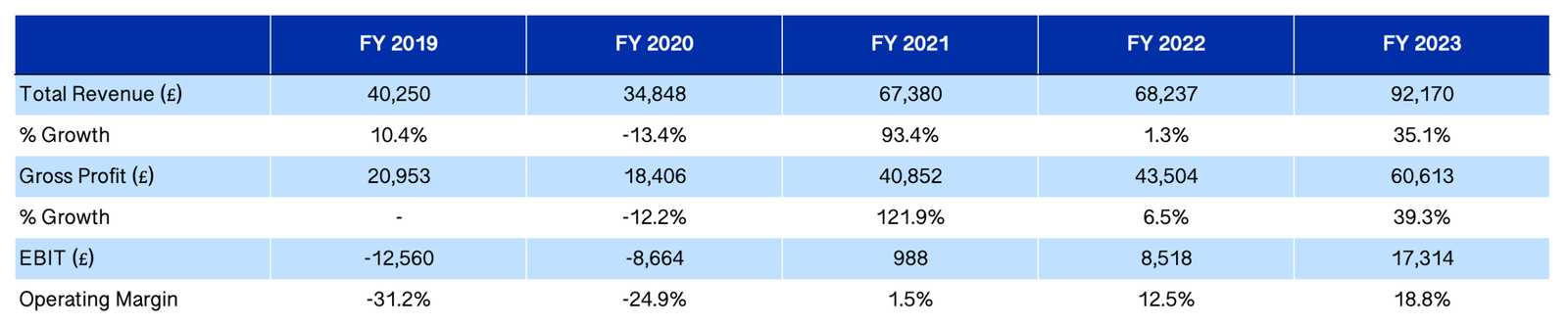

Optegra Key Financials

All non-percentage values expressed in £0,000s

Revenues of £92M in FY 2023 place Optegra in the mid-market tier for UK private healthcare providers. Clinics in this range operate multiple sites and offer high-demand elective procedures; at this size, Optegra establishes good market coverage without being as capital-intensive as major hospital groups such as Spire Healthcare.

In the private healthcare sector, operating margins typically range from 10–15%, reflecting moderate profitability after covering clinical and overhead costs. Optegra’s 18.8% operating margin in FY 2023 is larger than that of key competitors including London Vision Clinic and Optimax.

Whilst Optegra’s revenue growth in FY 2022 was only 1.3%, EBIT growth increased by +760% from one year earlier. This represents a significant shift in cost structure or efficiency; or both. Explanations for this include:

- A Case Mix Shift Towards High-Margin Procedures

More private-pay or premium surgeries and/or fewer lower-margin NHS procedures. Evidence supporting this is limited however. - An 11.3% Reduction in Wages

A post-Pandemic efficiency drive, a shift from permanent staff to contracting or outsourcing, or reduced overtime or furlough phase-out likely lowered operating costs. - A More Than Half Reduction in CapEx

A more asset-light operating model or asset disposals lifted EBIT. - An Increase in Net Intangible Assets from £360k to £19M

A major accounting event, likely due to additional investment from Mid Europa to acquire further clinics in Poland and Czechia; businesses operating under higher margins.

Overall, Optegra demonstrates strong cost discipline, with a sustained post-pandemic rebound in gross profit and consistently high-margin procedures driving profitability.

EssilorLuxottica’s acquisition of Optegra is therefore significant. It represents a strategic, novel purchase of more than 70 eye clinics and diagnostic facilities, allowing the company to tap into clinical revenue streams in the European market.

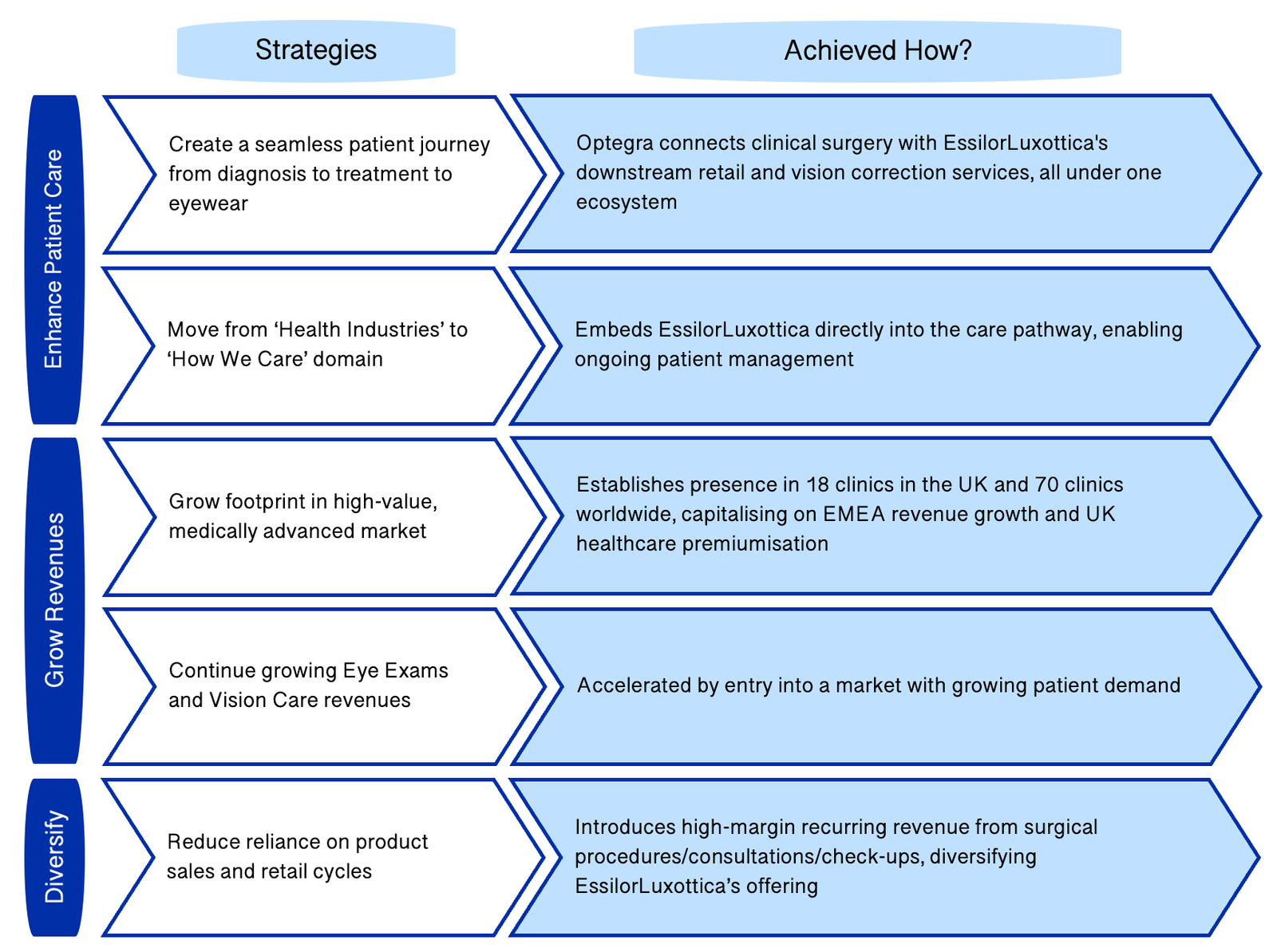

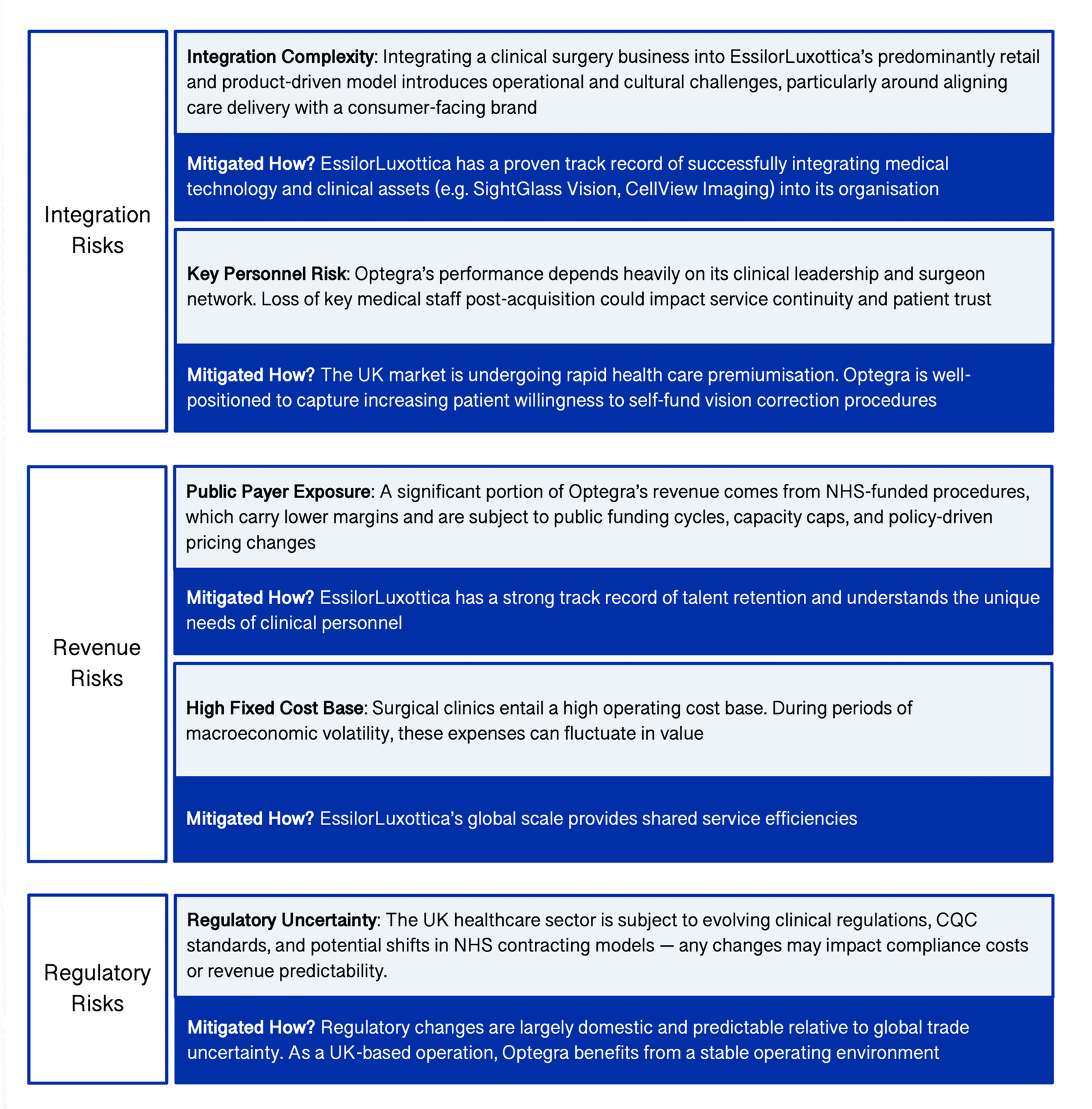

Strategy

Acquiring Optegra Reaps Rewards for EssilorLuxottica…

…As Well As Bringing Risks

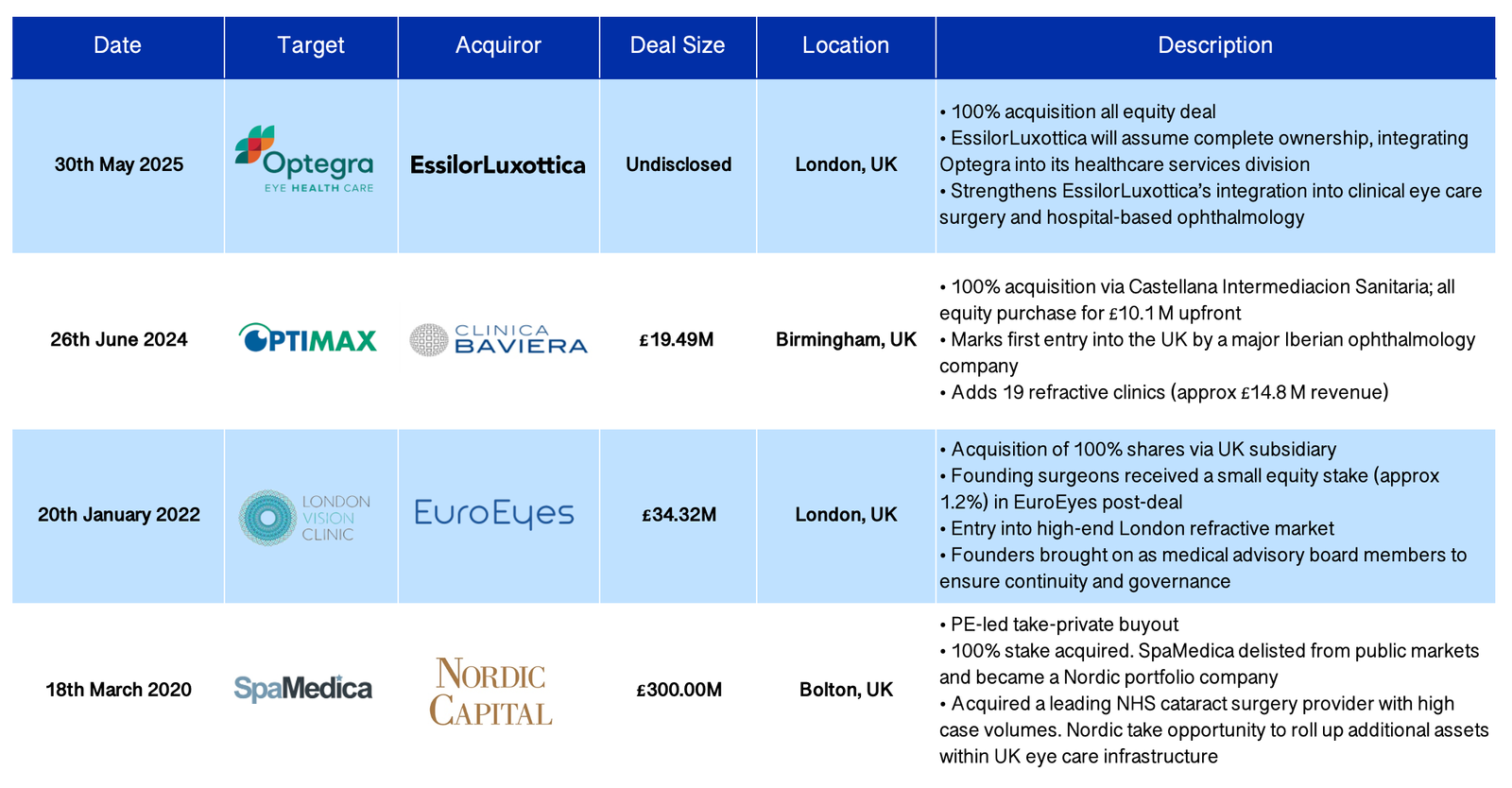

Prior Acquisitions of Ophthalmology Clinics

In Europe, Ophthalmology clinic acquisitions are not uncommon. Recent transactions made within this subsector include:

Clinica Baviera, EuroEyes and Nordic Capital were new entrants into the UK private ophthalmology sector, recognising the potential for profitability in a high-demand and capacity-constrained market.

Each pursued full ownership of their respective targets. For EuroEyes, a minority stake was retained by London Vision Clinic’s founders, likely to retain specialist expertise in presbyopia surgery.

Impact of Deal

EssilorLuxottica’s acquisition of Optegra reflects a broader strategy: one that looks beyond traditional sector boundaries towards opportunities that combine technology with consumer-centric care models.

By integrating innovations such as wearable lens technologies and artificial intelligence into Optegra’s clinical practices, EssilorLuxottica creates a seamless patient journey from diagnosis to treatment to eyewear.

The deal represents a series of programmatic acquisitions by the eyewear-manufacturing behemoth. It also represents a company that is dipping their toes into a novel subsector; structural tailwinds and a drive to increase EssilorLuxottica’s presence in European markets makes Optegra a suitable acquisition.

The success of this deal hinges on effective integration. If EssilorLuxottica can combine Optegra’s clinical expertise with its own technological edge, it could set a precedent for deeper moves into clinical eyecare, laying the groundwork for future acquisitions in a high-growth market.

Sources

PwC – Health Industries Deals Trends

Guy’s and St Thomas’ NHS Foundation Trust – 75 years of pioneering sight-saving work

ONS – UK population projections (Table A2-1)

College of Optometrists – UK Eye Care Data Hub report

Centre for Health and the Public Interest – Cataract outsourcing and NHS finances

Independent Healthcare Providers Network – Going Private 2024

British Medical Association – NHS backlog data analysis

Welsh Government – £120m to reduce waiting times

NHS England – RTT waiting times data 2024–25